Published

in Business

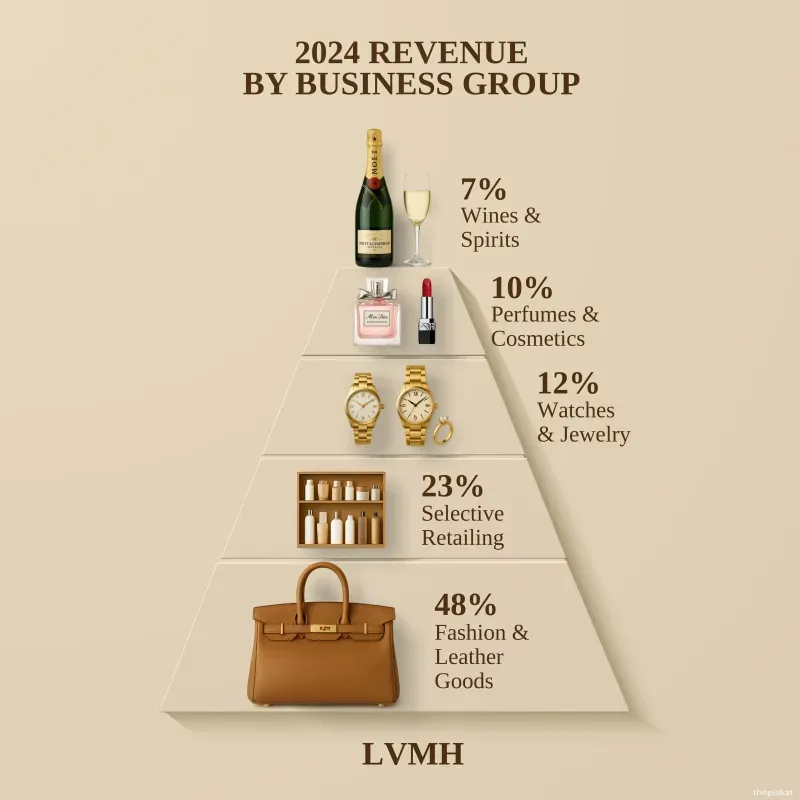

Luxury giant LVMH, owner of Louis Vuitton, Sephora, and Moët & Chandon, has released its 2024 revenue breakdown by business group. Fashion and Leather Goods dominate the chart, while Watches & Jewelry remain steady and Wines & Spirits decline.

LVMH Moët Hennessy Louis Vuitton is the world's leading luxury goods conglomerate, based in France. It comprises over 75 prestigious brands across five core sectors: Fashion & Leather Goods (Louis Vuitton, Fendi, Loewe), Selective Retailing (Sephora, DFS), Perfumes & Cosmetics (Guerlain, Acqua di Parma), Watches & Jewelry (TAG Heuer, Bulgari, Hublot), and Wines & Spirits (Moët & Chandon, Hennessy, Veuve Clicquot). The company operates globally with strong presence in Europe, Asia, and North America.

The Fashion & Leather Goods segment generated 48% of LVMH’s total revenue in 2024. This includes handbags, ready-to-wear clothing, shoes, and accessories from brands like Louis Vuitton, Celine, and Fendi. The growth in this segment is driven by high global demand, especially from affluent consumers in Asia and the United States, looking for quality, craftsmanship, and brand prestige.

Selective Retailing accounted for 23% of total revenue, led by Sephora’s expansive global footprint and DFS’s travel retail stores. This segment benefits from growing digital sales channels and an increased focus on customer experience. Demand for high-end beauty products and exclusive in-store events continues to attract loyal customers worldwide.

Watches & Jewelry made up 12% of the revenue. LVMH's portfolio includes luxury timepieces and high-end jewelry from brands like TAG Heuer, Zenith, Bulgari, and Hublot. These products are prized for precision engineering, luxury materials, and timeless design. The segment performed particularly well in Asian and Middle Eastern markets, where watch culture and jewelry gifting remain strong.

Perfumes & Cosmetics contributed 10% of the company’s revenue. The segment includes iconic brands such as Dior Beauty, Guerlain, and Givenchy. These products range from fragrances to skincare and makeup, catering to a wide global audience. The beauty sector continues to face fierce competition from niche brands and changing consumer habits favoring natural and sustainable ingredients.

The Wines & Spirits group brought in only 7% of total revenue, the lowest among all segments. Brands like Hennessy, Moët & Chandon, and Dom Pérignon remain iconic, but rising health awareness, regulatory pressures, and shifts toward non-alcoholic alternatives have impacted growth. Europe and the U.S. continue to be the largest markets, though volumes have stabilized or declined.

The infographic excludes segments contributing less than 1% of revenue, referred to as 'the rest.' These may include digital ventures, experimental business units, or new categories like virtual fashion and B2B services. While currently small in terms of revenue, these segments reflect LVMH’s innovation strategy and willingness to explore emerging markets and technologies.

LVMH stands for Moët Hennessy Louis Vuitton, a French multinational conglomerate specializing in luxury goods.

The Fashion & Leather Goods segment, with 48% of the total revenue.

It includes global retail operations such as Sephora and DFS (duty-free stores), and increasingly digital retail channels.

Health trends, regulatory limits, and the growing popularity of non-alcoholic alternatives have reduced the segment’s growth rate.

Brands include TAG Heuer, Bulgari, Hublot, and Zenith—renowned for their luxury watches and fine jewelry.